Sugar Rush: Consumers Kick Off Halloween Shopping Earlier Than Ever – The Food Institute

Shoppers are eager to carve out some finds this season. Nearly half (47%) of consumers report getting a jump start on Halloween shopping before October, up ten percentage points from 2019 and two percentage points from 2023, according to an annual survey from the National Retail Federation.

Halloween spending is projected to hit $11.6 billion, shy of last year’s record $12.2 billion in sales.

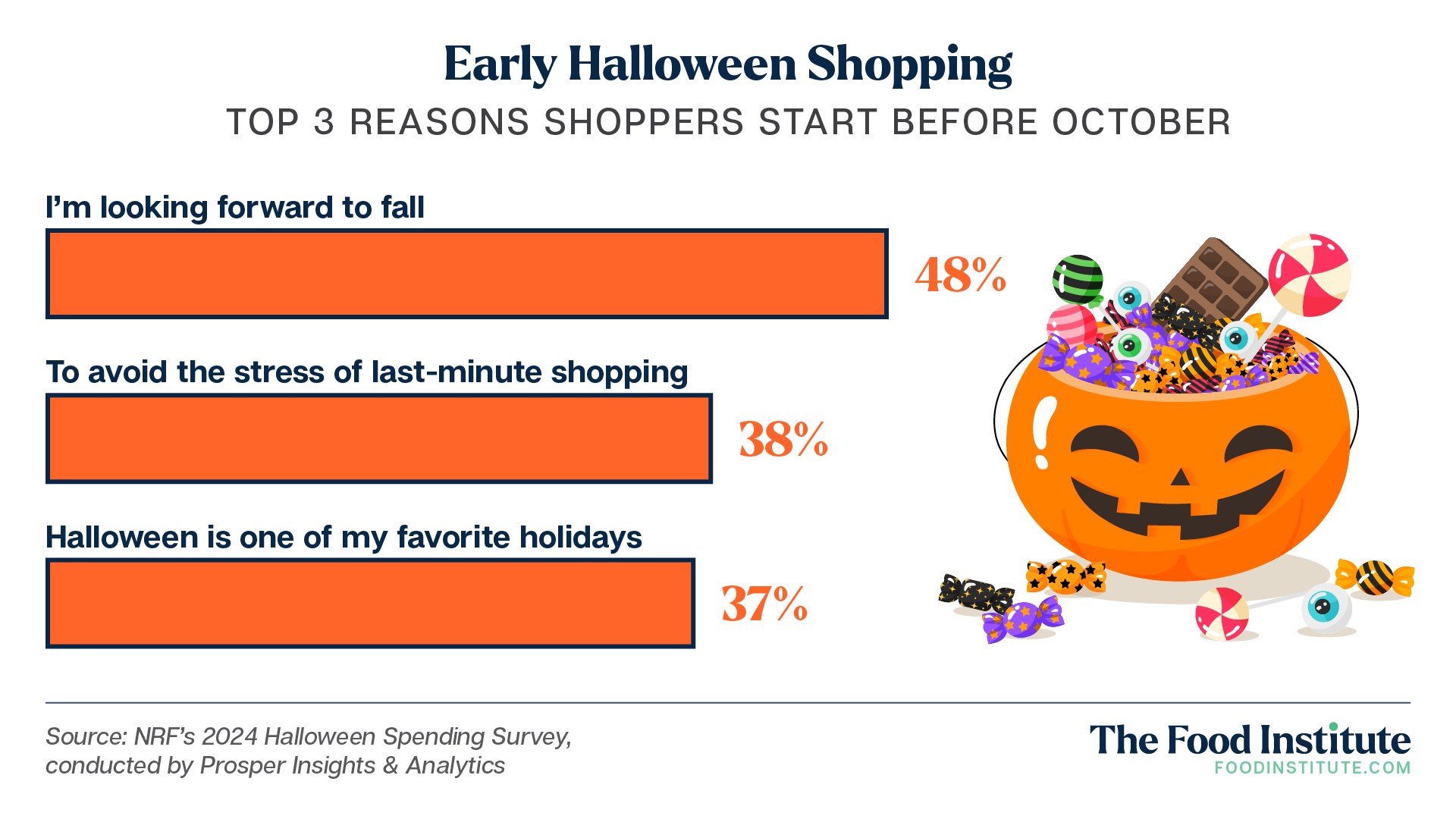

When asked why they’re getting a head start on Halloween shopping, consumers cite looking forward to the fall season (48%), avoiding last-minute shopping stress (38%), and general excitement for one of their favorite holidays (37%).

“Halloween marks the official transition to the fall season for many Americans, and consumers are eager to get a jump start on purchasing new seasonal décor and other autumnal items,” said NRF VP of industry and consumer insights Katherine Cullen in a statement.

“Retailers are prepared to meet this early demand by offering shoppers all the holiday essentials to make this year’s celebrations memorable,” she added.

Additional, key insights from the report:

- 72% of consumers plan to celebrate Halloween.

- Those participating in the season plan to spend a combined average of $103.63, slightly down from 2023’s record of $108.24.

- Top holiday activities include handing out candy (67%) and decorating a home or yard (52%). Throwing/attending a party was noted by just 29% of consumers.

Consumer Spending Takes a Sweet Turn

Halloween confectionery spending is expected to grow between 3-5% from last year’s $6.4 billion market share, according to a separate report from the National Confectioners Association. The organization cites persistent pandemic-era enthusiasm for the season and accelerated spending earlier into the season as motivators for the sales spike.

“It is clear that Halloween candy is a bona fide retail phenomenon in 2024, with demand from consumers starting earlier in the year,” said John Downs, CEO of the NCA.

The organization found that consumers’ favorite Halloween treats include chocolate, gummy candy, chewy candy, candy corn, hard candy, and lollipops. Additionally, they identified that iconography of pumpkins, ghosts, and bats on holiday-themed confectionery treats were among the most popular aesthetic choices.

Chocolate continues to haunt the hearts of celebrants. Of the top ten candies found in Halloween shopping carts, half are cocoa-based, according to research from DoorDash, which considered ordering data from October 2023. Topping the list is a nostalgic favorite: Reese’s Milk Chocolate Peanut Butter Cups. When evaluating the regionality of popular sweets across the U.S., the offering was preferred in 24 states. The next most popular item, Gushers Tropical Fruit Flavors Snacks, won out in 15 states.

The next most popular items include:

- Twix Caramel

- Snickers

- Nerd’s Sweet & Tangy Gummy Clusters

- Kit Kat King Size

- Trolli Sour Bite Crawlers

- Mike & Ike Chewy Candies

- Peanut M&M’s

General support for a diverse selection of confectionery treats this season highlights Halloween’s enduring claim on the category and shows that retailers can capture sales by offering an assortment of classic and themed candy varieties.

Some final food for thought: DoorDash found that Vermont, South Dakota, Nebraska, Iowa, and Arizona were the top states with the biggest sweet tooths based on the amount of candy purchased in the month leading up to Halloween. These findings may prompt confectionery brands to accelerate distribution and marketing in these regions.

The Food Institute Podcast

Restaurant results for the second quarter weren’t stellar, but people still need to eat. Are they turning to their refrigerators, or are restaurants still on the menu for consumers? Circana Senior Vice President David Portalatin joined The Food Institute Podcast to discuss the makeup of the current restaurant customer amid a rising trend of home-centricity.

Related

Exclusive | Dave Portnoy is quietly shopping a book

Barstool Sports founder Dave Portnoy is shopping a book, Page Six has exclusively learned. Portnoy’s agency UTA is repping the tome, sources te

We Track Sales For A Living. Here Are The 30…

As shopping experts, we shop slowly and carefully to discern if a sale offers the most bang for our buck. From everyday essentials to larger splurges, knowing w

Can you afford to be patriotic when grocery shopping?

CBCPenguins bask on the shore of King George Island near Brazil's Comandante Ferraz research station in Antarctica.Antarctica is like no place on Earth. The "W

Our Readers Top Loved Products Last Month Were All Sleep…

1TOP-TESTED COTTON SHEETSCalifornia Design Den Cotton SheetsNow 23% OffCredit: California Design DenWhy we love it: If you have been reading our What's In My Ca