H World Group: Robust Domestic Travel And Leisure Demand Outlook (NASDAQ:HTHT)

Thomas Barwick

Summary

I am positive on H World Group Limited (NASDAQ:HTHT). My summarized thesis is that the domestic travel & leisure industry in China is still very robust. Flight volume data has recovered very strongly and is seeing no signs of weakness even in July. I see this as a strong indicator of hotel demand, which is a big positive for HTHT. In addition, HTHT is executing very well on various growth initiatives that should better position it to capture demand. Given my positive outlook, I don’t think HTHT deserves to trade near its 5-year low.

Company overview

HTHT is a leading multi-brand hotel group with >10,00 hotels under its belt as of 2Q24. The operating model is via lease & owned [L&O] and franchised & managed [F&M]. In China, HTHT L&O is 6% of total hotels and 94% from F&M. In terms of number of rooms (in China), as of 2Q24, HTHT has ~974k rooms, of which L&O is ~84k of them and the rest from F&M. The business has operations primarily in China, where it derived 80% of FY23 revenue. The remaining 20% is split between 15% in Germany and 5% from the rest of the world. Operationally, L&O is 60% of total revenue, with the rest from F&M.

Earnings results update

In the latest quarter (2Q24) reported on 20th August, HTHT grew total revenue by 11% to ~RMB6.15 billion, of which L&O was ~RMB3.7 billion, F&M was ~RMB2.3 billion, and others were RMB133 million. This was coupled with a healthy gross margin expansion of 230bps to 39.3% million, and it helped HTHT translate revenue growth to higher EBIT growth of 14% (from RMB1.36 billion in 2Q23 to RMB1.57 billion in 2Q24). In terms of margin, EBIT margin expanded by 60bps y/y to 25.6%. By adj EBITDA (reported), margin improved 120bps y/y to 33.2%, coming in at RMB2.04 billion.

Travel demand remains strong

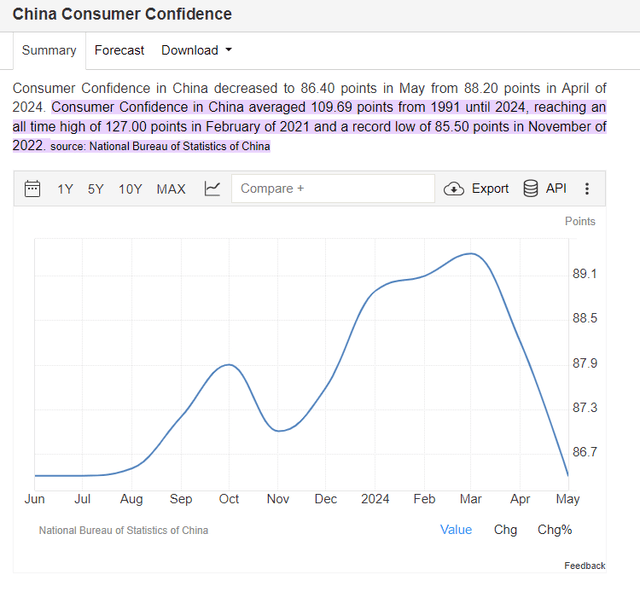

Tradingeconomics

The prevailing narrative for China is that the consumer spending environment is weak given the macro conditions, and this leads to a pullback in discretionary spending. This is in line with several companies that called out weak demand in China. For instance: (1) Sephora cut jobs in China; (2) WPP downgrade sales forecast in China; and many others. Naturally, the expectation is the travel & leisure industry is going to get impacted as well (in line with what the US is seeing).

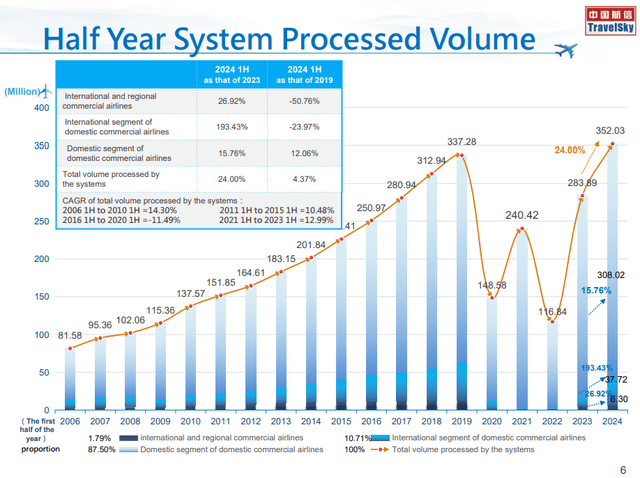

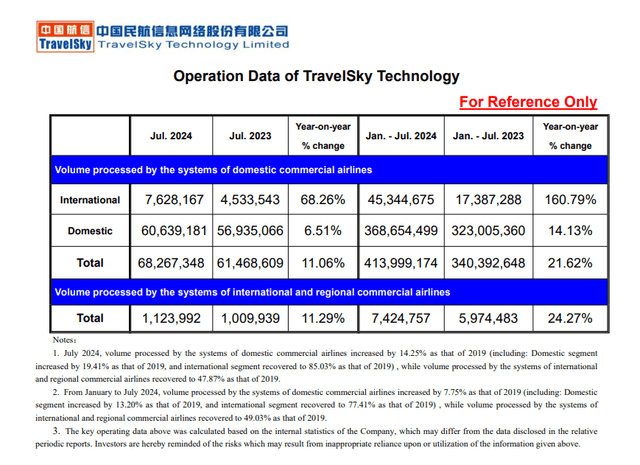

Travelsky

Travelsky

However, I beg to differ, as the domestic travel industry in China has been extremely robust. Above is a chart reported by Travelsky, and from the data we can see that total flight volume has already recovered above 2019 levels with a massive surge in on a y/y basis vs. 1H23 (24%). More notably, if you look at the table at the top right, the entire recovery is driven by domestic travel (international travel is down 50% vs. 2019). Even in the latest month reported (July), the demand strength remains extremely strong—14% y/y domestic growth.

The reason for highlighting this data point is that I see it as a strong demand indicator for hotels. Logically, higher flight volume should translate to higher hotel demand as travelers need accommodation to stay during their travel period. Indeed, looking at HTHT’s 2Q24 results, underlying operating metrics have painted a similar picture: (1) The occupancy rate has improved 80 bps y/y and 560 bps sequentially to 82.2%, and (2) total room sales grew 19% to 73.2 million in the quarter.

Multiple initiatives to drive growth

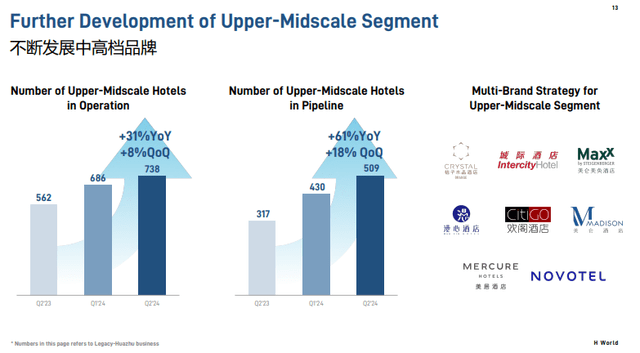

HTHT

Firstly, HTHT is executing very well on upgrading its existing economy and midscale hotels, especially among its three core brands: Hanting, Ji, and Orange (together representing 70% of the domestic hotel count). As of 2Q24, including those in the pipeline, the number of secured midscale and upscale hotels accounted for 52% of the total hotel count, which is 400 bps higher than hotels in operation only. Doing the math, it suggests that a large mix of hotels in the pipeline are for midscale and upscale hotels; this should result in HTHT enjoying higher ADR (which should drive RevPAR growth). Importantly, in the upper-midscale segment, HTHT’s brands (Crystal Orange, Intercity, and MAXX) have found healthy footing in capturing demand (as evident from the increased occupancy from 81.7% last year to 82.6% this year, which is higher than the group’s occupancy rate improvement). Another positive demand indicator (my logic is that franchisees would only want to open hotels that are in demand) that these brands are capturing demand is that HTHT has successfully increased hotels in operation and pipeline by 8% and 18% sequentially, respectively.

HTHT

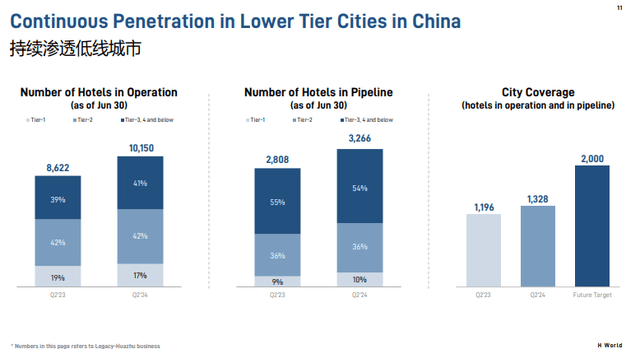

Secondly, following the launch of NiHao 2.0 in 1Q24, HTHT repositioned another economy brand, HI Inn, and redesigned its products with the 6.0 latest version launched in 2Q24. The HI Inn 6.0 is positioned as the ultimate value-for-money brand with an innovative digital operational system that combines guest self-service, digital front desk, and mobile staff. I am very positive about this strategy as it should help HTHT better capture demand from: (1) value customers (those that want to try but are tight on budget), and (2) the increasing popularity of traveling to lower-tier cities. With more supplies coming online, as seen from the increase in city coverage (up 11% y/y) and hotels (21% y/y growth in tier-3 and below cities), HTHT is definitely well positioned to continue capturing demand.

HTHT

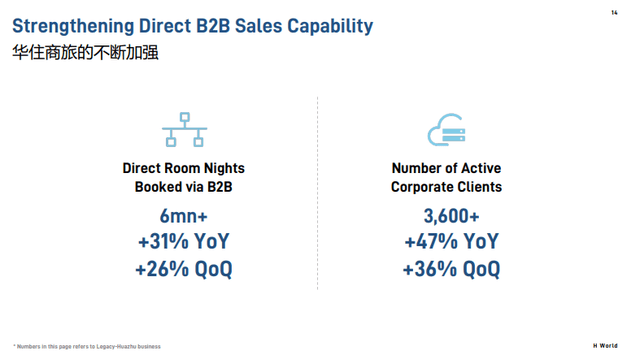

Lastly, HTHT has strengthened its direct B2B sales capability, which has translated into strong growth in terms of room nights booked and number of active corporate clients. To put things into perspective, the new 3.6k+ active corporate customers contributed >6 million (~8% of the group’s total) room-night bookings via its B2B platform (31% y/y). The bigger implication here is that it gives a very early sense of how strong the potential growth is when China goes into full macro recovery mode. With more active corporate clients on board, it also means that HTHT is better positioned to contact/convert sales at the onset of a recovery growth situation.

Valuation

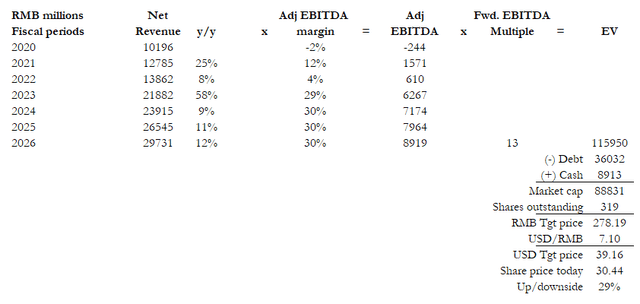

Source: Author’s calculation

I believe HTHT is worth 29% more than the current share price. My target price is based on FY26 adj EBITDA of RMB8.9 billion and forward EBITDA multiple of 13x.

Earnings bridge: I believe growth over the coming years is going to remain robust as consumer preference for travel proved to be resilient (as shown in the various data points above) and as HTHT ramps up its growth initiatives to capture this demand. Assuming a recovery back to HTHT’s pre-covid (2014–2019) average growth of 12% over the next 2 years, I got to ~RMB29.7 of revenue in FY26. I then assumed a flattish adj EBITDA margin as HTHT is likely to reinvest excess profits back into the business to drive growth. This led to my RMB8.9 billion of adj. EBITDA in FY26.

Valuation justification: The major upside driver is multiples rerating upwards. I don’t believe HTHT should trade at the current ~9x forward EBITDA multiple. For comparison, the current 9x is almost at the lowest point over the past 5 years, even lower than the COVID period, which doesn’t make sense considering the growth outlook (potential for further acceleration when the Chinese economy recovers). Another way to look at this is by comparing HTHT against Shangri-La Asia, which is trading at 13x forward EBITDA but expected to grow slower (expected growth is low to mid-single-digits) than HTHT. As such, I believe HTHT should at least trade back to 13x forward EBITDA (it traded at 13x two months ago, for reference).

Investment Risk

The Chinese economy could further weaken from here, and this may result in a heavy blow to the domestic travel and leisure industry, thereby impacting HTHT. Moreover, this comes at a time when HTHT is ramping up its supply and various growth initiatives. Lower-than-expected demand coupled with increased OPEX will drive a double whammy to adj EBITDA, which will further weigh on valuation.

Conclusion

My positive view on HTHT is because of the robust domestic travel & leisure demand outlook in China. According to recent flight volume data, it indicates a strong underlying demand for hotels, which benefits HTHT. HTHT is also executing well on growth initiatives like brand upgrades and B2B sales expansion, further positioning it to capture this demand. While a potential economic slowdown in China presents risk, HTHT’s current valuation is very attractive at near its 5-year low (which doesn’t reflect the growth outlook).

Related

Turkish Airlines and Qatar Airways Suspend Mogadishu Flights Following US…

Home » Airlines News of Qatar » Turkish Airlines and Qatar Airways Suspend Mogadishu Flights Following US Embassy Terror Alert, Raising Security Concerns at

Local tourism destinations grow fast

Men sit at the Doha Corniche backdropped by high buildings in Doha on March 3, 2025. Photo by KARIM JAAFAR / AFP DOHA: Local tourism destinations are g

Hajj, Umrah service: Qatar Airways introduces off-airport check-in for pilgrims

Image credit: Supplied Qatar Airways has introduced an off-airport check-in

IAG, Qatar Airways, Riyadh Air, Turkish Airlines, Lufthansa & more…

Turkish Airlines – a Corporate Partner of the FTE Digital, Innovation & Startup Hub – is charting a course to rank among the top 3 global airlines for