Corporate Travel Management Insiders Placed Bullish Bets Worth AU$1.49m

Multiple insiders secured a larger position in Corporate Travel Management Limited (ASX:CTD) shares over the last 12 months. This is reassuring as this suggests that insiders have increased optimism about the company’s prospects.

Although we don’t think shareholders should simply follow insider transactions, we do think it is perfectly logical to keep tabs on what insiders are doing.

Check out our latest analysis for Corporate Travel Management

The Last 12 Months Of Insider Transactions At Corporate Travel Management

The MD & Executive Director Jamie Pherous made the biggest insider purchase in the last 12 months. That single transaction was for AU$1.4m worth of shares at a price of AU$15.98 each. So it’s clear an insider wanted to buy, even at a higher price than the current share price (being AU$12.93). Their view may have changed since then, but at least it shows they felt optimistic at the time. In our view, the price an insider pays for shares is very important. Generally speaking, it catches our eye when insiders have purchased shares at above current prices, as it suggests they believed the shares were worth buying, even at a higher price.

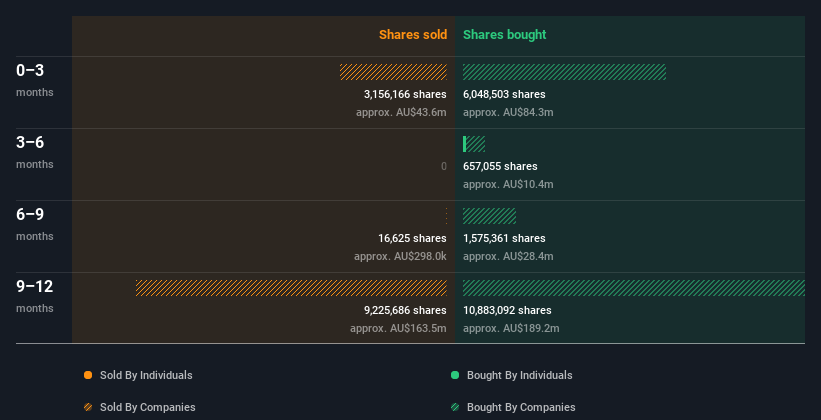

Corporate Travel Management insiders may have bought shares in the last year, but they didn’t sell any. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Insider Ownership Of Corporate Travel Management

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. We usually like to see fairly high levels of insider ownership. Corporate Travel Management insiders own 13% of the company, currently worth about AU$247m based on the recent share price. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Do The Corporate Travel Management Insider Transactions Indicate?

There haven’t been any insider transactions in the last three months — that doesn’t mean much. However, our analysis of transactions over the last year is heartening. Judging from their transactions, and high insider ownership, Corporate Travel Management insiders feel good about the company’s future. In addition to knowing about insider transactions going on, it’s beneficial to identify the risks facing Corporate Travel Management. In terms of investment risks, we’ve identified 1 warning sign with Corporate Travel Management and understanding it should be part of your investment process.

But note: Corporate Travel Management may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Related

Turkish Airlines and Qatar Airways Suspend Mogadishu Flights Following US…

Home » Airlines News of Qatar » Turkish Airlines and Qatar Airways Suspend Mogadishu Flights Following US Embassy Terror Alert, Raising Security Concerns at

Local tourism destinations grow fast

Men sit at the Doha Corniche backdropped by high buildings in Doha on March 3, 2025. Photo by KARIM JAAFAR / AFP DOHA: Local tourism destinations are g

Hajj, Umrah service: Qatar Airways introduces off-airport check-in for pilgrims

Image credit: Supplied Qatar Airways has introduced an off-airport check-in

IAG, Qatar Airways, Riyadh Air, Turkish Airlines, Lufthansa & more…

Turkish Airlines – a Corporate Partner of the FTE Digital, Innovation & Startup Hub – is charting a course to rank among the top 3 global airlines for