Class-action lawsuit targets Game of Silks, founders

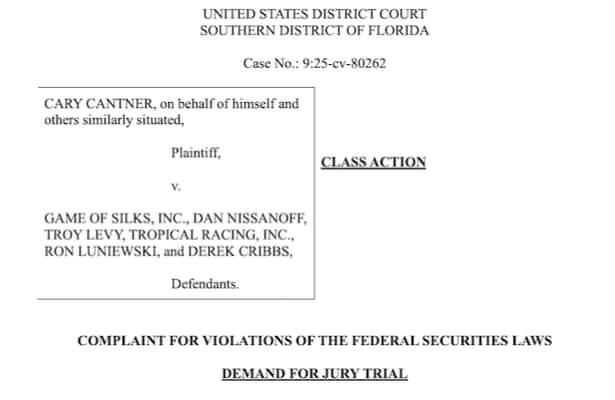

A Game of Silks player filed a class-action suit against the company and its founders, claiming they violated federal securities laws.

The suit was filed Monday by Florida resident Gary Cantner on behalf of himself and others who purchased non-fungible tokens that represented racehorses in the Game of Silks computer game.

Besides the company, the defendants are co-founder and vice president Troy Levy; his company, Tropical Racing, which invested in Game of Silks; Dan Nissanoff, CEO and co-founder; chief operating officer Ron Luniewski; and CFO Derek Cribbs.

Levy did not respond to a request for comment.

According to the lawsuit, Game of Silks was designed to replicate the real-world horse racing industry in a virtual setting, allowing users to assume roles similar to those in the actual sport. Through the use of various NFTs, players could immerse themselves in the roles of horse owners, stable managers, landowners and syndicate members. Purchasers of the NFTs would win money when their corresponding real-life horses won races.

It began with the sale of silks avatars in 2022, and horse NFTs were sold in October 2022.

“Each Silks Horse NFT was a derivative asset tied to a real-world thoroughbred racehorse, and owners were promised increasing rewards based on the horse’s performance over time,” according to the lawsuit.

In March 2024, Game of Silks launched the sale of its Season 2 silks horse NFTs at an initial price of $1,250, which was later reduced to $875, according to the lawsuit.

“The defendants developed a community of investors who were interested in owning virtual racing horses in order to promote the sale of the Game of Silks NFTs, bring in funds to develop the company, and develop a secondary market for the NFTs,” the lawsuit claims, and cites numerous examples of how investors could profit.

Game of Silks formed partnerships with the New York Racing Association, NYRA Bets, The Jockey Club and Fox Sports’ America’s Day at the Races, but none of them were named as defendants.

The market for the Silks horse NFTs “froze” in July 2024, according to the lawsuit, and “the lack of interest in season 2 Silks horses NFTs caused their price on the secondary market to plummet. Defendants stopped making payments on the winnings of the season 1 Silks horses NFTs by July 2024 even though the horses continued to run races and win purses in the real world.”

The lawsuit also claims that although the governance of the game was supposed to be decentralized, “the leadership team centralized decision-making and kept critical financial information hidden from the community.”

The lawsuit claims that sale of these crypto assets were investment contracts, and therefore they were securities under federal law. But, it claims, a registration statement has never has been in effect, or even filed, to register the securities with the U.S. Securities and Exchange Commission.

The defendants “made numerous untrue statements of material fact or omitted to state material facts necessary to make the statements made not misleading in subject matters related to the securities,” according to the lawsuit.

The lawsuit claims that “all money, assets and benefits defendants have unjustly received because of their actions rightfully belong to the plaintiff and the class members.

The lawsuit requests a jury trial and asks for damages in an amount that may be proven at trial plus fees, costs and interest.

Related

Leading Parx jockey Sanchez will serve 7-day suspension

Photo: Jason Moran / Eclipse Sportswire Jockey Mychel Sanchez will serve a seven-day suspension and pay an additional $1,750 in fines

Bill Mott talks about plans for Sovereignty, Just F Y…

Photo: Gulfstream Park / Lauren King Sovereignty, dramatic late-running winner of the Fountain of Youth (G2) March 1, is being pointed

Up-and-coming Cavalieri chases Grade 1 glory in Beholder Mile

Photo: Santa Anita / Benoit Photo Cavalieri and Alpha Bella, who finished one-two in the Grade 3 La Cañada in January at Santa Anita,

4 stakes showcase shipping stars on Tampa Bay undercard

Photo: Gonzalo Anteliz Jr. / Eclipse Sportswire The stars will shine Saturday at Tampa Bay Downs, and not just in the Grade 3 Tampa Ba