Ban on Gas-Powered Cars Would Eliminate Nearly 200,000 Auto Manufacturing Jobs

The Biden-Harris Administration has finalized regulations severely restricting sales of gas-powered cars. Under the new rules, conventional vehicles may make up no more than one-third of new motor vehicle sales by 2032. Many policymakers have proposed going even further and completely banning the sale of conventional and hybrid vehicles, only permitting sales of electric vehicles (EVs). For example, then-Senator Kamala Harris (D-CA) supported legislation that would completely ban conventional and hybrid vehicle sales. During her 2020 presidential campaign, Harris similarly proposed banning all gas-powered cars.

Industry analysts, including liberal organizations, have warned that forcing Americans to switch to electric vehicles would eliminate many auto manufacturing jobs. The main reason for this is that electric vehicles require fewer parts and less labor to manufacture than vehicles powered by internal combustion engines. However, analysts have paid little attention to how EV mandates will affect individual states. This report uses data from the Quarterly Census of Employment and Wages (QCEW) to estimate national and state-specific job losses from a ban on gas-powered vehicle sales.

The Biden-Harris Administration EV mandate is estimated to cost 123,000 existing auto-manufacturing jobs. A complete ban on gas-powered and hybrid vehicle sales would eliminate 191,000 existing auto-manufacturing jobs nationwide. The most severe impacts would hit the Midwest, with Michigan alone losing 37,000 jobs.

Electric Vehicle Mandates

Many public officials have sought to restrict the production of gas-powered vehicles and force Americans to switch to 100 percent electric or hybrid cars instead. In 2024, the Environmental Protection Agency finalized regulations restricting carbon dioxide emissions from newly built cars. It is physically impossible for conventional gasoline-powered vehicles to meet the new standards. Consequently, the rule effectively forces automakers to shift production to electric vehicles, which do not directly use fossil fuels or emit carbon dioxide (although the power plants from which electric vehicles draw electricity typically do). The Biden-Harris Administration estimates that, under the rule, conventional gas-powered vehicles could make up no more than one-third of newly built vehicles by 2032 (Joselow, 2024).

Vice President Harris has gone even further, proposing to ban sales of new gas-powered cars completely. As a U.S. Senator, Harris co-sponsored the Zero Emissions Vehicles Act, which would have required that 100 percent of new car sales be emissions-free by 2040 (2019). This would ban the sales of both conventional gas-powered cars and hybrid vehicles. Harris also co-sponsored the Green New Deal, which included provisions for zero-emission vehicle infrastructure (S. Res. 59, 2019). During her 2020 presidential campaign, Harris similarly proposed banning sales of new gas-powered cars and hybrid vehicles by 2035 (Kamala Harris For The People, 2019).

Vice President Harris has declined to answer reporters’ questions about whether she still supports banning gas-powered and hybrid vehicles, giving an official response of “no comment” to reporters’ queries (Thompson & Geman, 2024). If a future administration adopted the policies Harris proposed in the Senate and banned the production of gas-powered automobiles (including hybrids), it would have significant consequences for both American drivers and auto-manufacturing workers.

Most Americans Prefer Gas-Powered Cars

EVs have advantages and disadvantages compared to gas-powered automobiles. Charging an EV typically costs less than fueling a conventional car, and EVs also have lower maintenance costs and faster acceleration. However, EVs have shorter ranges and take significantly longer to charge than filling up a gas tank. EV charging infrastructure is also less widespread than gasoline stations.

Although some Americans want EVs, Americans generally prefer conventional vehicles. The Deloitte 2024 Global Automotive Study found that two-thirds of Americans prefer their next car purchase to be a gas-powered vehicle, 6 percent prefer an entirely battery-powered car, and 21 percent prefer a hybrid vehicle (Deloitte, 2024, p. 6). A recent survey of car dealerships also found that 45 percent of dealerships reported they would not sell EVs under any circumstances (Lewis, 2023).

After purchasing an EV, a significant proportion of drivers switch back to conventional vehicles. One study found that one-fifth of California EV owners returned to purchasing gas-powered vehicles, primarily because of the inconvenience of charging EVs (Powell et al., 2022, p. 39). Another survey looked at all Americans—not just Californians—who purchased a new vehicle in 2017. That study found that about half of EV owners chose not to buy another EV when they bought a new car. Respondents indicated that range, recharging time, and reduced performance in cold weather were key reasons for switching back to gas-powered vehicles (Dua & Bansal, 2021, p. 3).

EVs appeal to some Americans, but without substantial government intervention, they would likely remain a niche market. However, the Biden-Harris Administration is now forcing automakers to produce primarily—and Americans to purchase—EVs. Vice President Harris has previously proposed a complete ban on gas-powered cars and hybrids. In addition to their consequences for drivers, these policies threaten many auto manufacturing jobs.

EVs Require Fewer Workers

EVs use very different technology than conventional vehicles and are mechanically much less complex. Conventional vehicles have many interconnected moving parts that convert the energy from burning gasoline to motion while processing exhaust. These parts include catalytic converters, gears, clutches, and torque converters. None of these parts are needed in electric vehicles, which consist of relatively simple motors and a battery. Ernst and Young report that conventional vehicles have 2,000 moving parts in their powertrains, while Tesla EV drivetrains have only 17 (Canis, 2019, p. 2).

Consequently, EVs require fewer workers to assemble. Automakers like Ford and Volkswagen report that EV manufacturing requires 30 percent to 40 percent less labor than gasoline-powered vehicles (United Auto Workers, 2020, p. 13; Bushey, 2022). Moreover, parts suppliers—not final assembly plants—employ more than two-thirds of auto manufacturing workers.[3] About one-quarter of those parts workers produce gasoline engines and parts or powertrain and transmission parts—jobs that would be largely eliminated by a shift to EVs (U.S. Bureau of Labor Statistics, 2023).

EV Mandates Will Eliminate Auto Jobs

Auto industry analysts have accordingly noted that EV mandates will eliminate many existing auto manufacturing jobs. Brett Smith, director of technology at the Center for Automotive Research, explained that “[t]he industry is going through a transition unlike anything we’ve ever seen. There’s a pretty strong chance that there will be fewer people building these cars, fewer people building the parts to these cars, and that will create challenges in some automotive communities” (Levin, 2022).

Analysts across the ideological spectrum project substantial job losses. In 2018, analysts projected EVs would account for about one-fifth of new U.S. vehicle sales by 2030 (International Energy Agency, 2018, p. 80; Cooper & Schefter, 2018, p. 2). That year, the United Auto Workers (UAW) union estimated that the shift to electric vehicles would eliminate 35,000 of its members’ jobs (Bogage, 2022). That figure accounts for nearly 1 in 10 UAW members.

UAW research director Jennifer Kelly has publicly predicted that “[t]he workers who are making engines and transmissions today, their jobs will be eliminated when we make a transition to electric vehicles” (Beene & Coppola, 2018). She warns that “electric, to me, is where the real risk is to our membership” (Dawson et al., 2019).

In 2021, the Biden-Harris Administration set a target of EVs accounting for half of all new vehicle sales by 2030 (The White House, 2021). The left-wing Economic Policy Institute estimated that, without substantial government intervention, hitting this target would eliminate 75,000 auto manufacturing jobs (Barrett & Bivens, 2021).

Foreign analysts similarly project that EV mandates will eliminate many auto-related jobs overseas. For example, the European Union has advanced aggressive EV mandates. The European Association of Automotive Suppliers estimated that by 2040, these measures will eliminate a net of 275,000 jobs in automotive suppliers (Sigal, 2021). Japanese analysts expect EVs to eliminate more than 80,000 auto-related jobs in their country by 2050 (Yamada & Abe, 2021).

Great Lakes Region Particularly Hurt

EV mandates will particularly affect the industrial Midwest. The tri-state region of Indiana, Michigan, and Ohio is the heartland of U.S. automobile production, particularly for gas-powered vehicles, transmissions, and related parts manufacturing. More than two-fifths of U.S.-built vehicles and nearly three-fifths of U.S.-built transmissions are manufactured in these three states (Massachusetts Institute of Technology, 2022, p. 2). These states account for 43 percent of U.S. autoworkers, including more than 65,000 workers who produce parts for motor vehicle powertrains, transmissions, or gasoline engines (U.S. Bureau of Labor Statistics, 2023).

Industry analysts have noted that an EV transition will be particularly painful to the Midwest (Massachusetts Institute of Technology, 2022, pp. 21-22). As Lawrence Burns, former vice president for research and development at General Motors, told reporters, “If you play this out in a five- to 10-year time frame, employment ramifications for states like Michigan and regions like southeast Michigan and northwest Ohio are really going to be a big deal” (Grzelewski, 2020).

Table 1 shows motor vehicle manufacturing employment in the tri-state area and the entire U.S., including both employees on primary assembly lines and employees in parts production. Michigan, Ohio, and Indiana have significantly more jobs—and thus economic disruption—at stake from EV mandates than any other region of the country.

Job Loss Estimates

While EV mandates are widely expected to eliminate existing auto manufacturing jobs—especially in the Midwest—few public estimates are available for how EV mandates will affect individual states. The America First Policy Institute used data from the Bureau of Labor Statistics’ Quarterly Census of Employment and Wages to model the net national auto manufacturing job losses from the Biden-Harris Administration’s 2024 EV mandate and the potential impact of a complete ban on gas-powered cars.

Based on the automaker and UAW estimates discussed above, the model assumes EVs require 30 percent less labor—and thus 30 percent fewer workers—to assemble than conventional vehicles. It also assumes that positions in gas engines and parts manufacturing facilities do not have a role in producing EVs and that four-fifths of positions involved in producing transmission and powertrain parts are similarly unnecessary for EV production. The methodological appendix explains the model in detail.

This model focuses only on auto manufacturing jobs; it does not estimate jobs created or lost in other sectors, such as car dealerships, vehicle maintenance facilities, or battery manufacturing. Workers cannot easily transition between these sectors because they generally involve different skill sets (St. John, 2022). As a European industry association explained, battery manufacturing “typically requires more academically schooled workers and less vocationally trained workers than the production of transmission systems, fuel tanks or other powertrain components” (European Association of Automotive Suppliers, 2022).

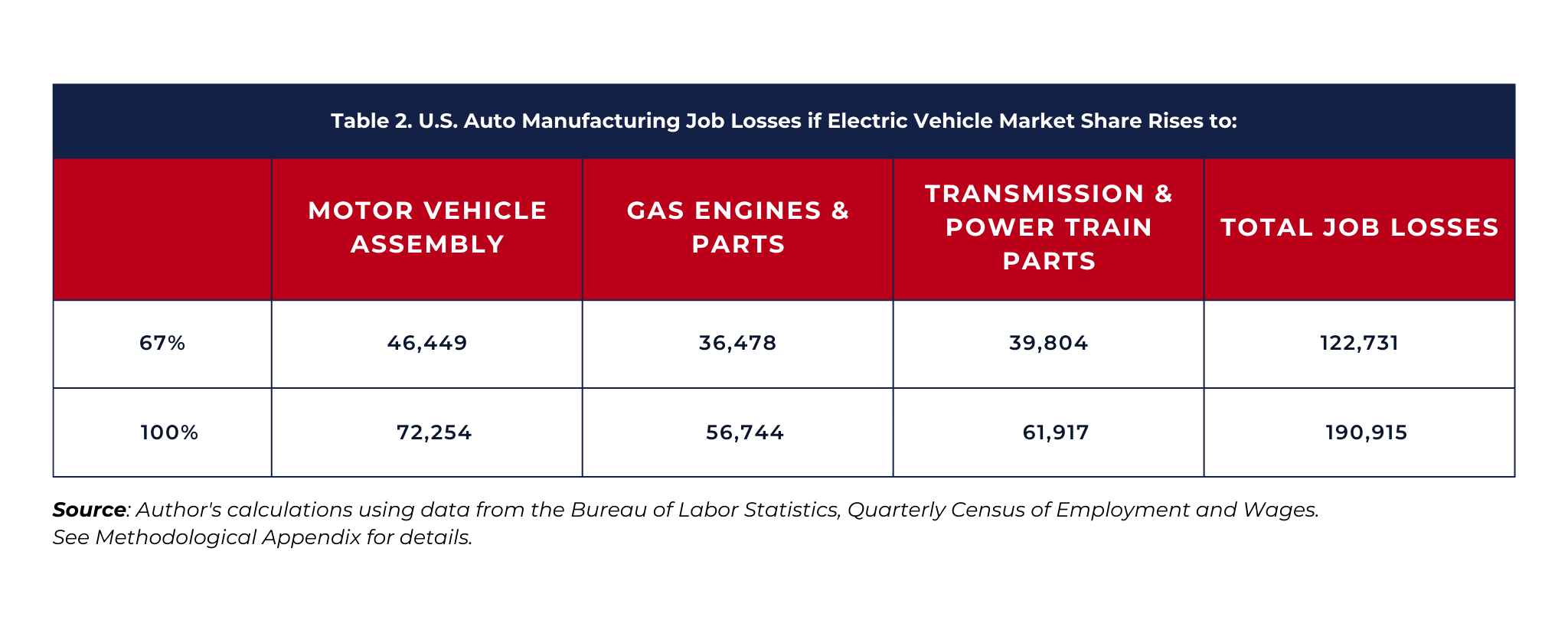

In 2023, electric vehicles accounted for 7.6 percent of U.S. motor vehicle sales (Kelley Blue Book, 2024). Table 2 shows estimated net national auto-manufacturing job losses—in both final assembly and parts manufacturing—if EV sales rise to 67 percent of the market, the proportion the Biden-Harris Administration estimates is required to comply with their new EPA rule (Joselow, 2024). Table 2 also shows how many auto manufacturing jobs would be lost under the complete ban on gas-powered car sales that Vice President Harris previously proposed.

If EVs rise to 67 percent of U.S. vehicle sales the model estimates that almost 123,000 net auto-manufacturing jobs will be lost. If the government completely bans the sale of conventional gas-powered cars and hybrid vehicles—as policymakers like Vice President Harris have previously proposed—the model estimates 191,000 auto manufacturing jobs would be lost.

About five-eighths of those job losses would come from parts manufacturers. The remaining jobs would be lost in final assembly positions. The Biden-Harris Administration’s EV mandate will substantially reduce auto-manufacturing employment. An administration that adopted Harris’s proposal for a complete ban on gas-powered car sales would eliminate even more jobs.

Job Losses by State

Previous studies do not provide state-specific estimates of EV-induced job losses. Table 3 on the following page presents “best-case scenario” estimates of auto-manufacturing job losses by state if the federal government were to ban sales of gas-powered cars and hybrid vehicles. The model assumes that existing auto manufacturers would retain their market share through the EV transition and that they would build these EVs at their existing facilities instead of closing some plants and opening new facilities in different states. Under these optimistic assumptions, total job losses are driven only by the aggregate labor efficiencies in EV assembly and by the elimination of engine and powertrain part manufacturing positions.

Table 3 presents auto manufacturing job losses in the nine states that, under this best-case scenario, would experience the greatest job losses under a gas-powered car ban. These states collectively account for almost 131,000 of the 191,000 jobs lost nationally. Overall, the Midwest would bear the brunt of job losses, although several southern states would also see significant losses.

Michigan is projected to experience the worst job losses, with about 37,000 jobs lost. About 14,000 of those jobs would occur in final assembly, while about 23,000 would be in parts manufacturing. Indiana and Ohio would suffer the next worst losses, with 24,000 and 22,000 jobs lost, respectively. Tennessee (-12,000), South Carolina (-9,000), and Alabama (-9,000) would also experience large job losses.

However, the Midwest is likely to see substantially greater job losses than these best-case projections. EV mandates are likely to push auto manufacturing jobs out of the Midwest. Tesla dominates EV manufacturing, accounting for over half of EVs sold in 2023 (Kelley Blue Book, 2024). It is likely that Tesla would take considerable market share from other automakers if the government forced them to switch to EVs. This would mean higher employment in Tesla’s California, Texas, and forthcoming Nevada manufacturing facilities but even lower employment in Michigan, Ohio, and Indiana. Similarly, many of the traditional auto manufacturers are building their EVs in new facilities outside the tri-state area. Ford Motor Co., for example, has announced plans to create a large assembly plant for electric trucks in Tennessee (Ford, 2021). This shift would mitigate job losses in Tennessee but would result in even worse job losses for Michigan.

Job losses from vehicle electrification have already begun. As part of its push to focus on electric vehicles, General Motors announced plans in 2018 to eliminate 8,000 salaried positions and 6,000 hourly positions, closing five North American assembly plants (Goldman, 2018). In 2022, Ford Motor Co. announced plans to eliminate 3,000 positions as part of its shift to electric vehicles (Peiser & Halper, 2022). Stellantis (which now owns Chrysler) announced plans in 2023 to eliminate 3,500 hourly positions in the U.S. as it reorients to produce electric vehicles (Moore, 2023).

Industry Impact

EV mandates have also put the auto industry under considerable strain. Ford has reported massive losses on every EV sold, causing the automaker to cut back production (Hawkins, 2023). In 2023, Ford lost $4.7 billion, selling 72,608 EVs (Ford, 2024a; Ford, 2024b). That represents losses of about $65,000 per EV sold. Ford expects to lose between $5 billion and $5.5 billion on EV products in 2024 (Ford, 2024b).

General Motors has significantly lowered its 2024 EV production target due to slower-than-expected demand in the U.S. market and several years of losses associated with EVs (Johnson, 2024). While the Biden-Harris Administration wants to transition America to EVs, most Americans do not want to go along.

Conclusion

Requiring Americans to buy EVs they do not want has serious consequences for American workers. The Biden-Harris Administration has issued rules prohibiting gas-powered cars from making up more than a third of vehicle sales by 2032. Policymakers like Vice President Harris have proposed completely banning the sale of gas-powered cars and hybrid vehicles. This would eliminate many existing auto manufacturing jobs. Electric vehicles require fewer parts and less labor to produce than gas-powered vehicles. The existing Biden-Harris Administration rules will eliminate 123,000 auto manufacturing jobs. If a future administration adopts Vice President Harris’s proposal for a complete ban on gas-powered cars and hybrids, at least 191,000 auto manufacturing workers will lose their jobs. Even under a best-case scenario, the Midwest would lose many jobs, with Michigan (-37,000), Indiana (-24,000), and Ohio (-22,000) experiencing the worst losses. If—as seems likely—EV mandates cause Tesla to expand its market share at the expense of traditional automakers, the Midwest would see even greater job losses.

Works Cited

Related

A top recruiter says sports marketing roles are hot right…

Jobs are opening up in the sports industry as teams expand and money flows into the industry.Excel Search &

Public employees and the private job market: Where will fired…

Fired federal workers are looking at what their futures hold. One question that's come up: Can they find similar salaries and benefits in the private sector?

Mortgage and refinance rates today, March 8, 2025: Rates fall…

After two days of increases, mortgage rates are back down again today. According to Zillow, the average 30-year fixed rate has decreased by four basis points t

U.S. economy adds jobs as federal layoffs and rising unemployment…

Julia Coronado: I think it's too early to say that the U.S. is heading to a recession. Certainly, we have seen the U.S. just continue t