What’s in Store for Allegiant Travel (ALGT) in Q2 Earnings?

Allegiant Travel Company ALGT is scheduled to report second-quarter 2024 results on Jul 31 after market close.

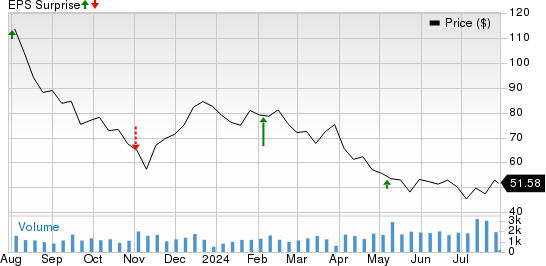

Allegiant Travel has a promising earnings surprise history, having surpassed the Zacks Consensus Estimate in three of the four preceding quarters and missing in one, the average beat being 29.31%.

Allegiant Travel Company Price and EPS Surprise

Allegiant Travel Company price-eps-surprise | Allegiant Travel Company Quote

The Zacks Consensus Estimate for ALGT’s soon-to-be-reported quarter’s earnings has been revised downward by 16.8% in the past 60 days to 84 cents per share. Meanwhile,the Zacks Consensus Estimate for revenues is pegged at $659 million, which indicates a decline of 3.6% year over year.

Our estimate for revenues from the passenger segment is pegged at $583.1 million, down 9.3% compared with the second-quarter 2023 actuals. Meanwhile, estimates for revenues from the third-party products segment are pegged at $28.6 million.

Rising operating expenses are hurting Allegiant Travel’sbottom line. This surge in operating expenses is primarily driven by the increase in salaries and benefits, exacerbating ALGT’s prospects in the to-be-reported quarter. Our estimate for total second-quarter operating expenses has increased 9.1% year over year.

Moreover, even though fuel prices have come down from the highs witnessed a year ago, they have remained at an elevated level. Per our model, the average fuel cost per gallon for the June-end quarter in 2024 will be $2.90.

What Our Model Says

Our proven model does not conclusively predict an earnings beat for Allegiant Travel this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here.

Allegiant Travel has an Earnings ESP of -1.47% and a Zacks Rank #5 (Strong Sell) at present. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Highlights of Q1

Quarterly earnings per share of 57 cents beat Zacks Consensus Estimate of 51 cents but declined 81.3% year over year. Operating revenues of $656.4 million outperformed the Zacks Consensus Estimate of $648.4 million and increased 1% on a year-over-year basis.

Passenger revenues, which accounted for the bulk (88%) of the top line, fell 4.8% on a year-over-year basis.

Stocks to Consider

Here are a few stocks from the broader Zacks Transportation sector that investors might want to consider, as our model shows that these have the right combination of elements to beat second-quarter 2024 earnings.

Copa Holdings CPA has an Earnings ESP of +1.55% and a Zacks Rank #3.The company is scheduled to report second-quarter 2024 earnings on Aug 7.

CPA surpassed the Zacks Consensus Estimate in each of the trailing four quarters. The average beat is 20.19%.

C.H. Robinson CHRW has an Earnings ESP of +5.29% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.The company is scheduled to report second-quarter 2024 earnings on Jul 31.

CHRW surpassed the Zacks Consensus Estimate in three of the preceding four quarters and missed once. The average beat is 2.07%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

C.H. Robinson Worldwide, Inc. (CHRW) : Free Stock Analysis Report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

Allegiant Travel Company (ALGT) : Free Stock Analysis Report

Related

Turkish Airlines and Qatar Airways Suspend Mogadishu Flights Following US…

Home » Airlines News of Qatar » Turkish Airlines and Qatar Airways Suspend Mogadishu Flights Following US Embassy Terror Alert, Raising Security Concerns at

Local tourism destinations grow fast

Men sit at the Doha Corniche backdropped by high buildings in Doha on March 3, 2025. Photo by KARIM JAAFAR / AFP DOHA: Local tourism destinations are g

Hajj, Umrah service: Qatar Airways introduces off-airport check-in for pilgrims

Image credit: Supplied Qatar Airways has introduced an off-airport check-in

IAG, Qatar Airways, Riyadh Air, Turkish Airlines, Lufthansa & more…

Turkish Airlines – a Corporate Partner of the FTE Digital, Innovation & Startup Hub – is charting a course to rank among the top 3 global airlines for