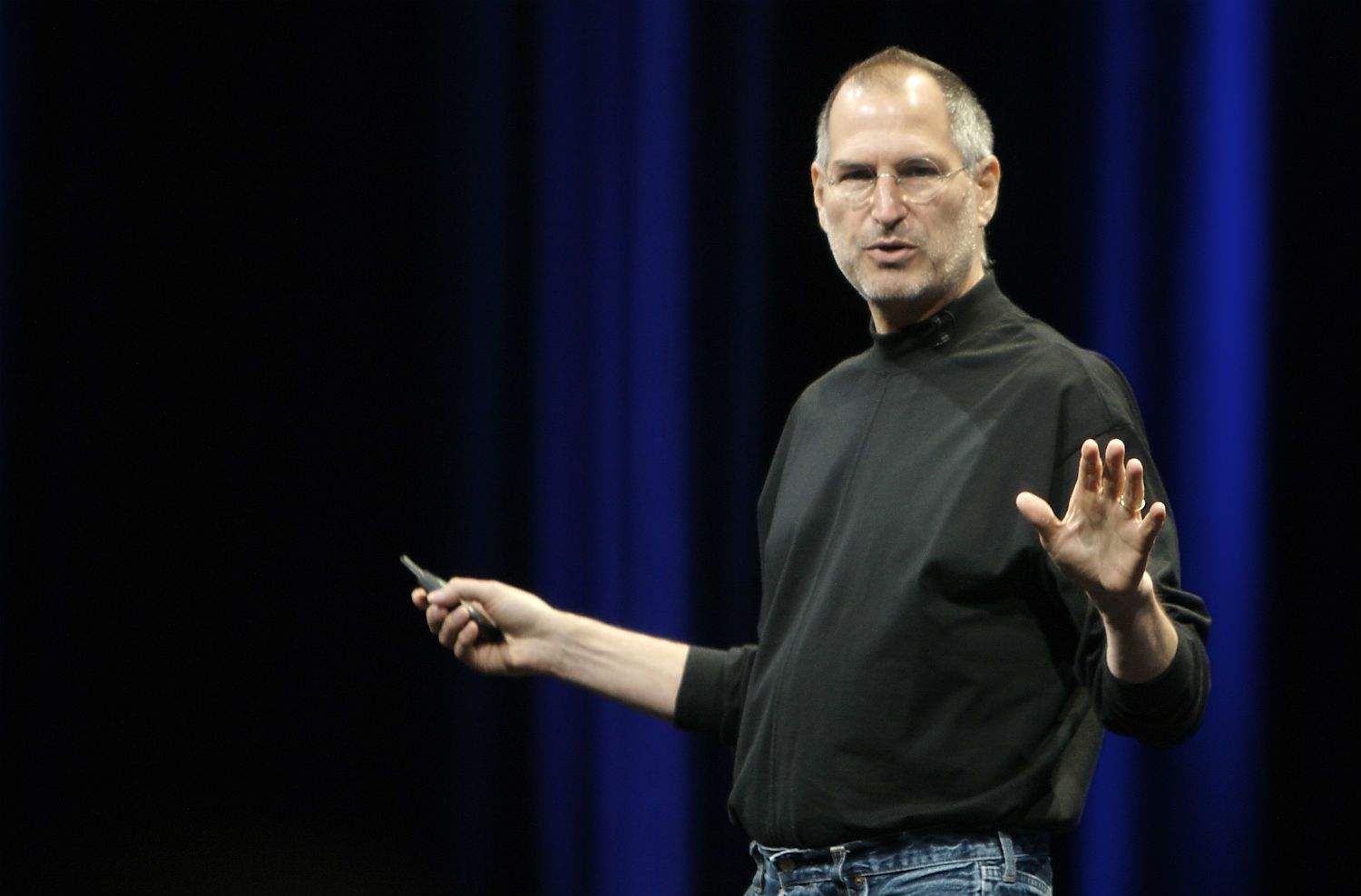

Today in Apple history: Pixar IPO makes Steve Jobs a billionaire

November 29, 1995: Capitalizing on the success of Toy Story, Pixar floats 6.9 million shares on the stock market. The Pixar IPO makes Steve Jobs, who owns upward of 80% of the animation studio, a billionaire.

After the windfall, one of the first people Jobs calls is his friend, Oracle co-founder Larry Ellison, who’s already a member of the billionaire’s club.

“Hello, Larry?” Jobs tells his friend on the phone. “I made it.”

Pixar IPO: Steve Jobs’ billionaire bet

Priced at $22 per share, Pixar (or PIXR, as it appeared on the NASDAQ stock exchange) hit a high of $49.50 on the day of its IPO. It closed at $39 on a volume of 4.8 million shares.

The success was largely driven by Toy Story, Pixar’s first feature-length animated movie, which became a massive hit upon release. A worldwide box office haul of $358 million made it a runner-up only to Aladdin and The Lion King in terms of animated movie blockbusters.

Pixar was one of the first tech companies to experience highly profitable IPOs during the tech boom of the mid-to-late-1990s. It followed the immensely profitable public offering of Netscape Communications in August 1995.

After the success of Netscape’s IPO, San Francisco investment bank Robertson Stephens agreed to underwrite the Pixar IPO. It filed with the SEC in October.

The start of the turnaround

Many people ignore Pixar (certainly compared to Apple) when listing Jobs’ great achievements. This happens for a couple of reasons, both of which seem related to the public’s general bafflement about the Apple co-founder’s involvement with Pixar.

For starters, Jobs invested in Pixar during his time outside Apple. He bought the majority interest in the animation studio from Star Wars creator George Lucas for just $5 million (and an extra $5 million in guaranteed funding) in early 1986, nearly a decade before the Pixar IPO.

This period of Jobs’ life oftentimes proves confusing. Outwardly, it looks like a decade-long stint in which Jobs hemorrhaged money on two apparently failing ventures. Somehow, he turned them around, became a billionaire and returned to Apple as a seasoned manager.

The other reason Jobs’ Pixar years get ignored? Unlike at Apple, Jobs did not act as a hands-on micromanager at Pixar. Although he played a big part in negotiating deals for the studio, he took a passive creative role. He simply sat back and watched a group of brilliant people (from whom he learned a great deal) achieve greatness.

Pixar IPO: The beginning of Steve Jobs’ third act

That said, Jobs truly deserved the Pixar IPO home run. He possessed an unswerving faith in the possibilities offered by computer-animated movies. And he funded this dream until Moore’s law caught up with it. He also helped broker the deal that brought Toy Story to silver screens.

After the IPO, Jobs negotiated a new five-picture deal between Pixar and Disney. It gave Pixar an equal share of the profits, along with merchandise and on-screen credits. (By way of contrast, the Toy Story deal tilted heavily in Disney’s favor.)

According to Pixar co-founder Ed Catmull, part of the reason for the IPO was that, with an equal split of profits, the studio also needed to put in 50% of movie production costs. That required money in the bank.

The Pixar IPO also started Jobs’ professional turnaround after a few disappointing years. Within a year of the IPO, Jobs was preparing his return to the Apple campus as part of a deal that saw Apple buy NeXT.

The rest, as they say, is history.

Related

10 Entry-Level Remote Jobs You Can Do From Anywhere

CS reps work directly with clients or customers to deliver a great customer experience. They answer questions, troubleshoot problems, and guide them through so

Trump has nominated only one Black American to his cabinet

Sign up for the daily Inside Washington email for exclusive US coverage and analysis sent to your inboxGet our free Inside Washington emailGet our free Inside W

Fed’s Next Moves In Focus With November Jobs Report Looming

What’s going on here?All eyes are on the Federal Reserve as November's nonfarm payrolls report approaches – it could influence interest rate predictions ami

Jobs data set to pave way for rates path, stocks…

By Lewis (JO:) Krauskopf NEW YORK (Reuters) - The coming week will give investors a fresh view into the health of the U.S. economy with the release of a clos