Helloworld Travel (ASX:HLO) Will Pay A Dividend Of A$0.06

Helloworld Travel Limited (ASX:HLO) will pay a dividend of A$0.06 on the 19th of September. The dividend yield will be 5.6% based on this payment which is still above the industry average.

Check out our latest analysis for Helloworld Travel

Helloworld Travel’s Payment Has Solid Earnings Coverage

We like to see robust dividend yields, but that doesn’t matter if the payment isn’t sustainable. The last dividend was quite easily covered by Helloworld Travel’s earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

Over the next year, EPS is forecast to expand by 28.7%. If the dividend continues on this path, the payout ratio could be 46% by next year, which we think can be pretty sustainable going forward.

Helloworld Travel’s Dividend Has Lacked Consistency

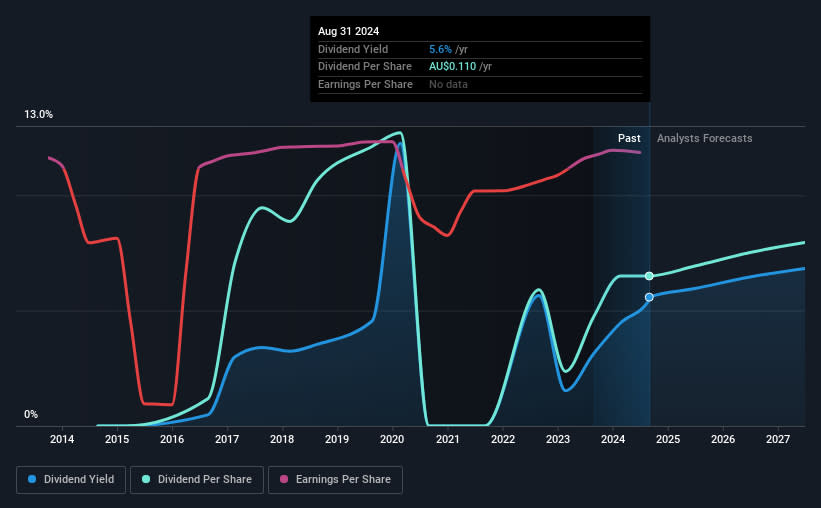

Even in its relatively short history, the company has reduced the dividend at least once. If the company cuts once, it definitely isn’t argument against the possibility of it cutting in the future. Since 2016, the dividend has gone from A$0.02 total annually to A$0.11. This implies that the company grew its distributions at a yearly rate of about 24% over that duration. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

Dividend Growth Is Doubtful

With a relatively unstable dividend, it’s even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. It’s not great to see that Helloworld Travel’s earnings per share has fallen at approximately 9.6% per year over the past five years. A modest decline in earnings isn’t great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. It’s not all bad news though, as the earnings are predicted to rise over the next 12 months – we would just be a bit cautious until this can turn into a longer term trend.

In Summary

In summary, while it’s good to see that the dividend hasn’t been cut, we are a bit cautious about Helloworld Travel’s payments, as there could be some issues with sustaining them into the future. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We don’t think Helloworld Travel is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we’ve picked out 1 warning sign for Helloworld Travel that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Related

Turkish Airlines and Qatar Airways Suspend Mogadishu Flights Following US…

Home » Airlines News of Qatar » Turkish Airlines and Qatar Airways Suspend Mogadishu Flights Following US Embassy Terror Alert, Raising Security Concerns at

Local tourism destinations grow fast

Men sit at the Doha Corniche backdropped by high buildings in Doha on March 3, 2025. Photo by KARIM JAAFAR / AFP DOHA: Local tourism destinations are g

Hajj, Umrah service: Qatar Airways introduces off-airport check-in for pilgrims

Image credit: Supplied Qatar Airways has introduced an off-airport check-in

IAG, Qatar Airways, Riyadh Air, Turkish Airlines, Lufthansa & more…

Turkish Airlines – a Corporate Partner of the FTE Digital, Innovation & Startup Hub – is charting a course to rank among the top 3 global airlines for