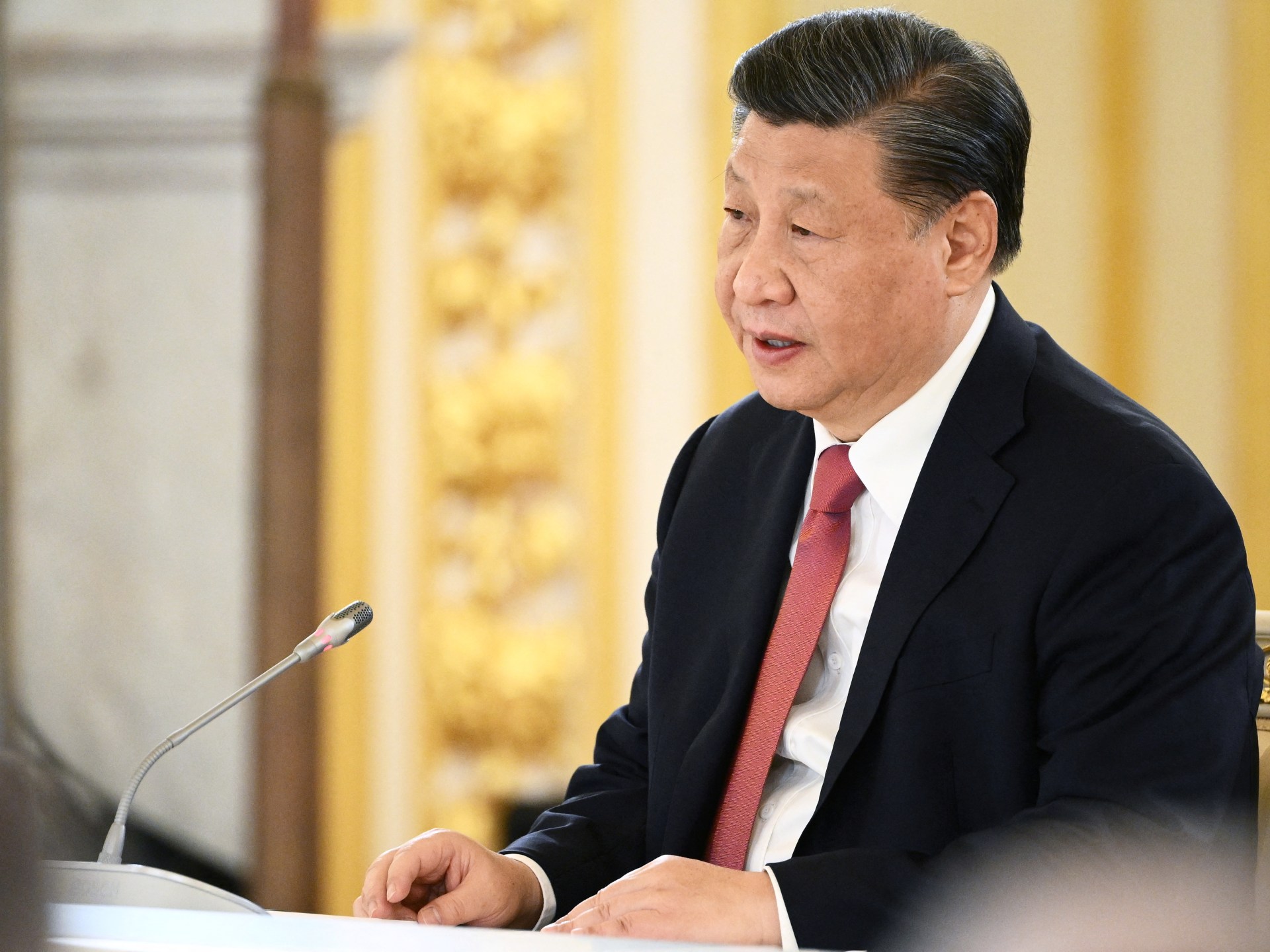

China’s Xi meets foreign business leaders amid jitters over economy

Taipei, Taiwan – Chinese President Xi Jinping met with American business leaders and academics at Beijing’s Great Hall of the People, state media has reported, as he tries to woo foreign investment back to China after a challenging few years for the world’s second-largest economy.

The meeting on Wednesday included Evan Greenberg, the chief executive of the US insurance company Chubb, as well as Stephen Orlins, the president of the National Committee on US-China Relations, and Craig Allen, the president of the US-China Business Council.

Like many Chinese state functions, the event was highly choreographed, with footage showing attendees arranged in a square formation offset by elaborate floral installations.

Xi last met with US executives in San Francisco following the APEC summit there in November.

The meeting offers an opportunity for Beijing to shore up ties with US companies amid tensions with Washington and signal that their investment is welcome.

Many of the world’s top executives are already in Beijing this week for the China Development Forum, which took place on Sunday and Monday.

The forum’s guest list includes World Bank President Ajay Banga, International Monetary Fund (IMF) Managing Director Kristalina Georgieva and representatives of more than 100 multinational firms.

While business leaders have been able to meet with many senior Chinese leaders in recent days, the invitation to meet Xi signals a concerted effort by Beijing to address negative perceptions about the current business environment.

“It’s possible that investors and executives will air some grievances at the meeting and it’s possible that lobbying might make some impact, but I don’t think that’s what this meeting is really about,” Chris Beddor, the deputy China research director at Gavekal Dragonomics, told Al Jazeera.

“This is primarily about Xi sending a message. The message is that the Chinese government is attuned to the concerns of global companies and investors, and still wants their presence in the country, at a time when global businesses are very wary of China.”

Last year, foreign direct investment in China fell by 8 percent as companies scaled back operations and sought to “de-risk” their businesses amid continuing geopolitical tensions and a tougher regulatory environment.

Tightened espionage and state secret laws have also made some firms question whether they are truly welcome, while the COVID-19 pandemic drew attention to their over-reliance on Chinese supply chains.

Still, some foreign companies have stressed their eagerness to double down on their investment.

Cook on Sunday told Chinese media that he hoped to increase Apple’s investment in China, where the company’s flagship iPhone has lost ground to local Huawei models like the Mate 60 Pro Plus.

“I think China is really opening up, and I’m so happy to be here,” Cook was quoted as saying on the sidelines of the China Development Forum.

Others, including the IMF’s Georgieva, are more jittery over China’s future.

During a speech at the China Development Forum, Georgieva told policymakers that more pro-market reforms are needed to help China’s economy rebound from the pandemic.

Despite growing 5 percent last year, China’s economy is struggling with deflation and a protracted real-estate crisis.

“China is poised to face a fork in the road – rely on the policies that have worked in the past, or update its policies for a new era of high-quality growth,” Georgieva said, suggesting that reforms could add $3.5 trillion to the economy over the next 15 years.

Shifting to consumption-focused growth, however, may be easier said than done in an economy marked by weakened domestic demand and sagging business confidence.

Chinese officials have long relied on mega infrastructure projects to boost gross domestic product (GDP), necessitating a mind shift among policymakers to move towards consumption-led growth.

Despite these concerns, China has set this year’s GDP target at 5 percent and pledged to continue its support for strategic sectors, among other goals outlined to attendees of the China Development Forum.

This year’s China Development Forum got off to a less rocky start than last year’s event, which was overshadowed by the aftermath of Beijing’s tough pandemic curbs and controversy over a Chinese spy balloon in US airspace.

“US-China tensions are a bit more stable this year, so the political pressure on American attendees has lessened somewhat,” Beddor said.

“There simply weren’t that many foreign visitors in China in March 2023. So it’s not surprising that attendance is up this year, because foreign travel of all sorts to the country is a bit more normal compared to last year,” he said.

Related

Qatar Business Leaders Optimistic About Long-Term Growth – HRO Today

Research from KPMG finds CEOs are prioritising resilience, technological innovation, and adaptability in 2025. By Maggie Mancini As organisations respond to glo

Indian Startups Showcase Innovation and Global Expansion at Web Summit…

Indian startups are making waves globally, and their latest venture at Web Summit Qatar 20

Qatar’s tax authority launches 100 percent financial penalty exemption initiative…

To qualify, companies must register on the Dhareeba Tax Portal and ensure that all taxpayer data is updatedQatar’s General Tax Authority recently announced th

India-Qatar Joint Business Forum held to Strengthen Bilateral Economic Ties…

NEW DELHI : On the sidelines of the visit of H.H. Sheikh Tamim bin Hamad bin Khalifa Al Thani, Amir of Qatar to In