ASX Value Picks: Flight Centre Travel Group And 2 More Stocks Trading Below Estimated Intrinsic Value

The ASX200 closed up 0.58% at 8,091.9 points, with the last day of the earnings season revealing mixed results across sectors. Retail sales data from July showed activity plateaued, prompting analysts to consider potential impacts on interest rates. In this context, identifying undervalued stocks becomes crucial for investors seeking opportunities amidst fluctuating market conditions. This article highlights three such stocks trading below their estimated intrinsic value, starting with Flight Centre Travel Group.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

|

Name |

Current Price |

Fair Value (Est) |

Discount (Est) |

|

Elders (ASX:ELD) |

A$9.20 |

A$18.11 |

49.2% |

|

Hansen Technologies (ASX:HSN) |

A$4.30 |

A$8.22 |

47.7% |

|

Ansell (ASX:ANN) |

A$29.83 |

A$57.03 |

47.7% |

|

VEEM (ASX:VEE) |

A$1.705 |

A$3.22 |

47% |

|

Millennium Services Group (ASX:MIL) |

A$1.145 |

A$2.24 |

48.9% |

|

MedAdvisor (ASX:MDR) |

A$0.445 |

A$0.86 |

48.1% |

|

Little Green Pharma (ASX:LGP) |

A$0.092 |

A$0.17 |

45.7% |

|

Clover (ASX:CLV) |

A$0.385 |

A$0.72 |

46.5% |

|

Aurelia Metals (ASX:AMI) |

A$0.155 |

A$0.3 |

47.5% |

|

Superloop (ASX:SLC) |

A$1.755 |

A$3.31 |

47.1% |

Let’s dive into some prime choices out of the screener.

Overview: Flight Centre Travel Group Limited offers travel retailing services for both leisure and corporate sectors across various regions including Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and internationally with a market cap of A$4.61 billion.

Operations: Flight Centre Travel Group Limited generates its revenue primarily from the leisure segment (A$1.35 billion) and the corporate segment (A$1.11 billion).

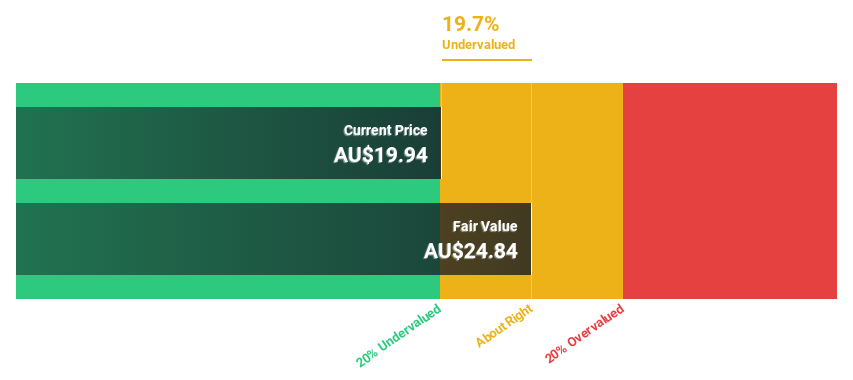

Estimated Discount To Fair Value: 40.3%

Flight Centre Travel Group is trading at A$20.97, significantly below its estimated fair value of A$35.10, indicating it is undervalued based on discounted cash flows. The company’s earnings are forecast to grow at 19.5% per year, outpacing the Australian market’s 12.3%. Recent full-year results showed net income surged from A$47 million to A$139 million, bolstered by strong sales growth and a robust balance sheet poised for strategic acquisitions and organic expansion in specialist travel sectors.

Overview: IDP Education Limited specializes in placing students into educational institutions across Australia, the United Kingdom, the United States, Canada, New Zealand, and Ireland, with a market cap of A$4.50 billion.

Operations: The company generates A$1.04 billion from its Educational Services – Education & Training Services segment.

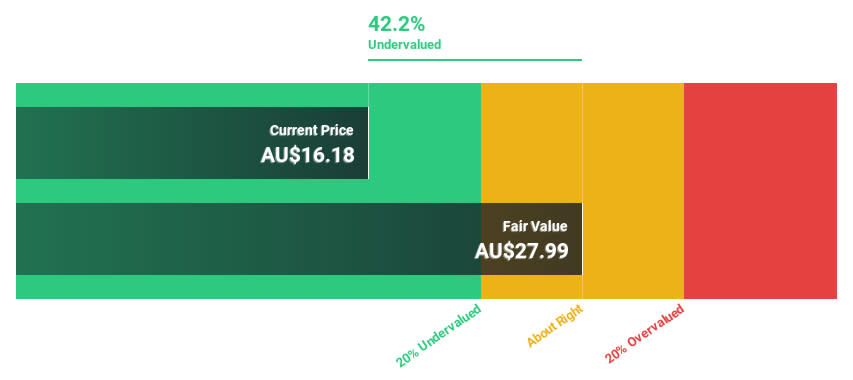

Estimated Discount To Fair Value: 42.2%

IDP Education is trading at A$16.18, well below its estimated fair value of A$27.99, suggesting it is undervalued based on discounted cash flows. Despite a recent dip in net income to A$132.75 million from A$148.52 million last year, revenue grew to over A$1 billion. Forecasts indicate earnings will grow 14.1% annually, faster than the Australian market’s 12.2%, and return on equity is expected to reach 31.3% in three years.

Overview: Vulcan Steel Limited (ASX:VSL) operates in New Zealand and Australia, focusing on the sale and distribution of steel and metal products, with a market cap of A$972.42 million.

Operations: Steel and metal product sales in New Zealand and Australia generated revenue segments of NZ$471.29 million for Steel and NZ$593.04 million for Metals.

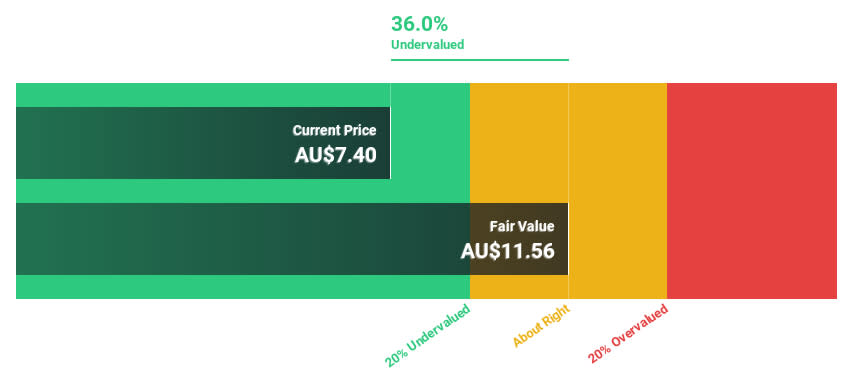

Estimated Discount To Fair Value: 36%

Vulcan Steel, trading at A$7.40 and estimated to have a fair value of A$11.56, appears undervalued based on discounted cash flows. Despite a drop in net income to NZD 39.99 million from NZD 87.9 million last year, the company is seeking acquisitions to bolster growth. Earnings are forecasted to grow significantly at 32.6% annually, outpacing the Australian market’s 12.2%. However, profit margins have declined from 7.1% to 3.8%.

Summing It All Up

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:FLT ASX:IEL and ASX:VSL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Related

Turkish Airlines and Qatar Airways Suspend Mogadishu Flights Following US…

Home » Airlines News of Qatar » Turkish Airlines and Qatar Airways Suspend Mogadishu Flights Following US Embassy Terror Alert, Raising Security Concerns at

Local tourism destinations grow fast

Men sit at the Doha Corniche backdropped by high buildings in Doha on March 3, 2025. Photo by KARIM JAAFAR / AFP DOHA: Local tourism destinations are g

Hajj, Umrah service: Qatar Airways introduces off-airport check-in for pilgrims

Image credit: Supplied Qatar Airways has introduced an off-airport check-in

IAG, Qatar Airways, Riyadh Air, Turkish Airlines, Lufthansa & more…

Turkish Airlines – a Corporate Partner of the FTE Digital, Innovation & Startup Hub – is charting a course to rank among the top 3 global airlines for